- Have any questions? Contact us!

- info@dr-rath-foundation.org

The Hague Complaint

June 14, 2003

IG Farben and the History of the “Business With Disease”

June 18, 2003The Investment ‘Business With Disease’

This presentation was given by Chris Fairhurst to The Hague Tribunal, 14th June 2003

Good Afternoon Ladies and Gentlemen. My witness statement this afternoon concerns the dubious business practices of a global industry – specifically, the pharmaceutical industry – and the financial interest groups supporting it. I shall refer collectively to this industry and its financiers throughout my testimony as the ‘Business With Disease’ for reasons that will already be obvious.

In the world of the ‘business with disease’ profit and the accumulation of wealth is the main driving force behind every decision taken. To the men who control these companies, it isn’t important how the profits (and hence the wealth) are generated, simply that they are.

Some of the biggest companies in the world make vast profits from businesses as diverse as computer software, retailing, insurance, oil – even your health. More accurately perhaps I should say, your ill health.

In the world of the ‘business with disease’ – and there is no bigger business in the world than the pharmaceutical industry – your well being does not make healthy profits for shareholders. However, your ill health does.

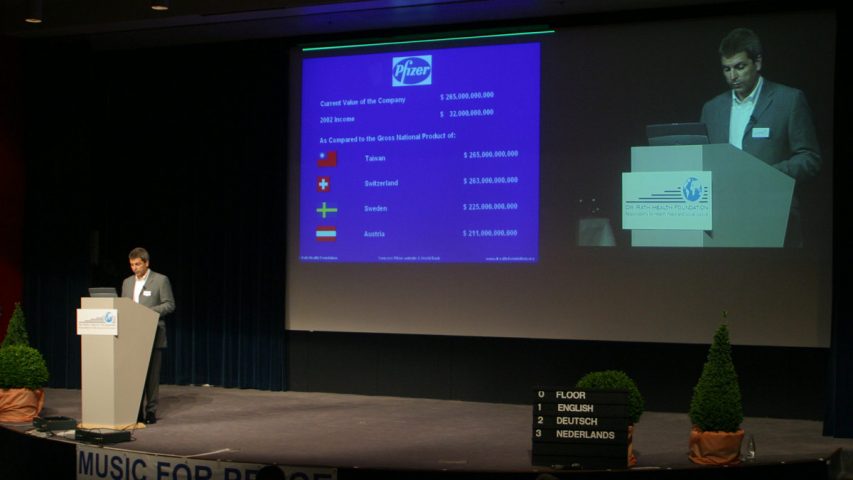

Consider the following evidence: the ‘business with disease’ makes more profit than any other industry on earth. In fact, it makes more profit than the automobile, chemical and airline industries combined. And these profits are made at the expense of your health.

A Brief History of the Development of the Pharmaceutical Industry

To explain why this is so, it is necessary to briefly consider the historic development of the ‘business with disease’

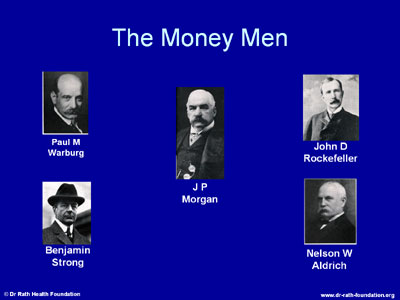

In the early part of the 20th century, a number of powerful and wealthy individuals who owned or managed a significant proportion of the corporate wealth of the United States, wealth that had been earned during the industrial revolution of the latter part of the 19th century, recognized that the ‘industrialization’ of health care would offer them further opportunities to control even more wealth and power.

By ‘rationalizing’ (as they described it) the provision of public health care and incorporating into this process the technological developments taking place in chemistry in the early 20th century, these men developed health care as a business – a business that would eventually lead to the patent based pharmaceutical industry of today.

The vast wealth of these men made it possible for them to set up and refine institutions and later companies that would guarantee them total control of the machinery of public health provision.

By continuously refining (and funding) these operations throughout the first half of the 20th century, these men were able to develop the business model of the pharmaceutical industry that we know today – a model that consists of the financial exploitation of patent rights over technologically produced and synthetically manufactured drugs.

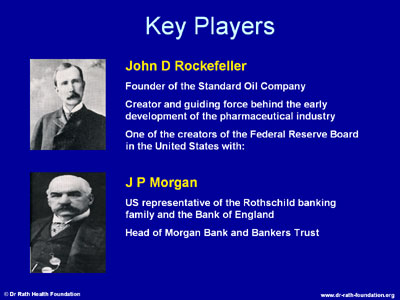

The most prominent of these individuals was an American called John D Rockefeller. A detailed history of his drive to create an industrialized health care system can be read on the website of the Dr Rath Health Foundation. The book describing how this man rigorously applied his undoubted business talents to the creation of a new industry to further his already massive wealth and power is called ‘Rockefeller Medicine Men’ and you will find it on the ‘History of the ‘Business With Disease’ page of the Foundation website.

Rockefeller liked people to think of him as a philanthropist, someone who used his vast wealth for the benefit of mankind but, in fact, he was probably one of the most ruthless and determinedly avaricious men in America.

Rockefeller’s Standard Oil Company dominated the oil industry throughout the early years of the 20th century and most of today’s major oil companies such as ExxonMobil and Esso are direct descendants of Standard Oil.

I shall return to this connection later.

Rockefeller’s business associates included the banker J P Morgan, the US representative for the Rothschild banking family and the Bank of England. Together, these two men helped to create the Federal Reserve Board of the United States, an institution that regulates all financial dealings in that country and which still exists today.

You may be familiar with the name J P Morgan through the current banking group J P Morgan Chase. The Chase part of this name comes from Chase Bank, owned by the Rockefeller family, demonstrating that these early associations have been maintained and survive to this day. I shall return to examine the J P Morgan Chase company later in this statement.

At this point in my statement, it is appropriate to consider the following exhibit.

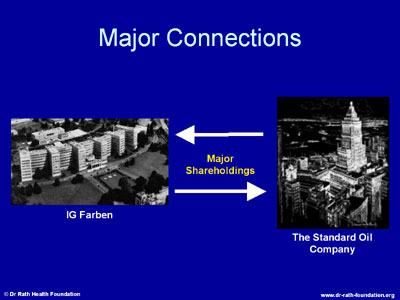

The Rockefeller family, through Chase Bank and the Standard Oil Company, together with J P Morgan through the Morgan Bank, were major financial supporters of Nazi Germany’s Third Reich. In fact Standard Oil was the largest shareholder in IG Farben and IG Farben was, next to the Rockefeller family, the largest shareholder in Standard Oil.

Through this relationship, and many others like it, the industrialized model of public healthcare was to gain a stranglehold in every developed country of the world. By investing heavily in medical research, doctors training, the manufacture and supply of medicines and public health policy, the patient-centered community systems that had gone before and that treated the patient as an individual were gradually swallowed up or abolished.

The industrialized model favored by the Rockefeller Medicine Men treated the patient as a customer and the medicines it produced as a commodity. Everything was geared towards the sale of products – and if the products happened to have side effects that created a market for more products to be sold, then so much the better.

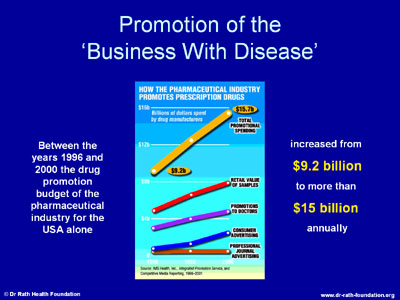

And this is still the business model being used today. Consider this exhibit:

During the 5 year period from 1996 to 2000, the pharmaceutical industry’s spending on the promotion of prescription drugs increased from $ 9.2 billion a year to $ 15.7 billion a year.

As a result of these business practices, the industrialized model of public healthcare carries an inbuilt counter-incentive to the removal of common diseases. To eliminate them would reduce the opportunities to sell more medicines and thus to make more money from continued ill health.

This business model was refined and extended throughout the second half of the 20th century to such an extent that the pharmaceutical industry overtook the petrochemical industry to become the largest and most profitable industry on earth.

Power and Wealth from Illness and Disease

This brief history of the development of the ‘business with disease’ sets the scene for my critical analysis of how this business has been refined up to the present day. For more detailed information about the history of the ‘business with disease’ please visit the Dr Rath Health Foundation website.

Having illustrated the history of its development, I shall now examine the current status of the ‘business with disease.’

As you can see from this table, more than a quarter of the 50 largest companies in the world today are either pharmaceutical or petrochemical companies. The Rockefeller business model obviously works. Please take a moment to study the table.

Why are petrochemical companies included in this list? The previous part of my statement may have provided some clues. Further explanation will follow shortly.

For now, I shall continue to concentrate on the pharmaceutical industry.

The companies in this table are ranked in order of their market value measured in billions of US dollars. Yes, ladies and gentleman of the jury, you should add 6 zeros to the figures in the table to arrive at the true values!

The only other industry that comes close to this level of wealth generation is the world of international finance – banks, insurance companies and investment management groups. I shall return again to this group later in my statement. For now, I would just ask you to note that J P Morgan Chase appear in this table at number 50.

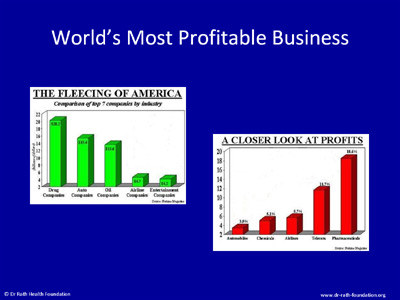

At number three in the table is Pfizer Incorporated. I should now like to take a closer look at their figures.

Pfizer is the largest of the pharmaceutical/petrochemical companies and is currently valued at around 265 billion dollars.

The company owns the patent rights to 8 of the world’s top 25 selling synthetic drugs (such as Lipitor, Viagra, Diflucan and Zoloft for example) and these patent rights enabled Pfizer to earn 32 billion dollars in 2002 from sales of their products.

To put these figures into some perspective, Pfizer’s current market value is greater than the wealth of several large and prosperous countries, as measured by the World Bank.

Returning to the table, at number 4 is ExxonMobil, the world’s largest petrochemical company. I referred to this company earlier in my statement. It is a direct descendant of the Rockefeller owned Standard Oil Company and this connection is the reason why petrochemical companies are part of my analysis.

Please now consider Exxon’s financial position.

Once again, the figures are almost beyond comprehension.

You may wonder why Exxon has a slightly lower market value than Pfizer when its income is more than 6 times greater.

The reason is that the petrochemicals business has higher operating costs than pharmaceuticals – in simple terms, as we have already seen, the pharmaceutical business is much more profitable.

An obvious question to pose at this point is: ‘who controls this vast wealth?’

All global companies whose shares are traded on the world’s stock exchanges have a Board of Directors who run the company on behalf of the owners. The owners of the company are the shareholders. If you own shares in any of the companies in the table, you are a part-owner of that company.

However, your shareholdings are individually too small to give you many ownership benefits. The major shareholders are the ones who have these rights and who enjoy the vast wealth and influence this brings with it.

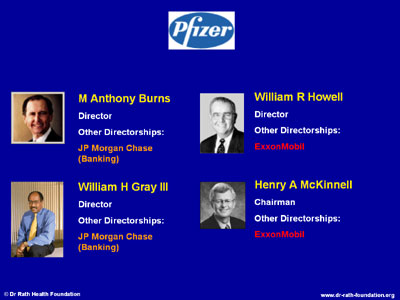

I should now like to carefully examine the directors and shareholders of the two companies presently under consideration. Turning first to Pfizer, upon investigation I found some key names on their Board of Directors,

I would ask you to pay particular attention to the other directorships held by these men and which are highlighted in the exhibit and to remember these as I move on to consider the board members of ExxonMobil.

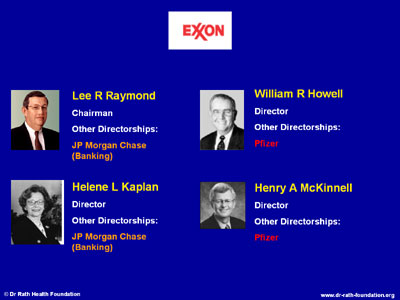

The same pattern of interlinking directorships is again demonstrated on Exxon’s board.

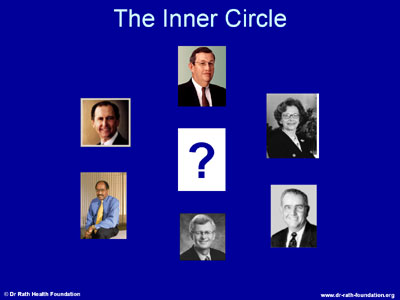

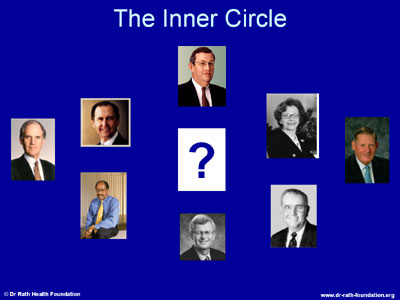

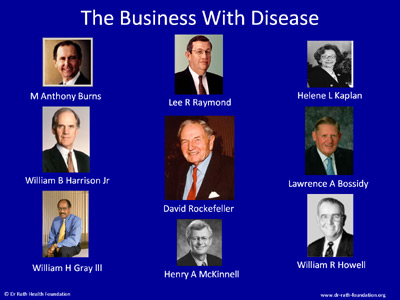

Since these people will meet regularly at Board meetings, on investment committees and at shareholder meetings, I have therefore put them together as a group.

This group, who control the daily operations of two of the largest companies in the world, not only sit on the boards of both companies, but also on the board of one of the world’s largest investment institutions – an institution that has enormous shareholdings in both pharmaceutical and petrochemical companies – JP Morgan Chase.

Please remember that it is the shareholders who own the companies and control the wealth so, if you are both a major shareholder and director of any company, you have total control of that company.

Not only control over how the company makes its money but also what it does with that money and who benefits from it. In the case of the ‘business with disease’ these multi- trillion dollar financial benefits are earned from the systematic promotion of diseases at the expense of good health.

I shall return to the mystery person in this group, after some further investigation.

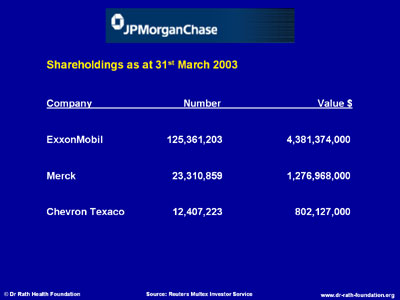

At this point, it is appropriate to consider the role of J P Morgan Chase in the ‘business with disease.’

The common thread here, apart from shared directorships is that, as I mentioned a moment ago, J P Morgan Chase is a significant shareholder of both pharmaceutical and petrochemical company shares.

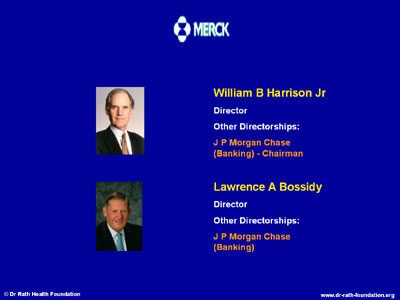

Here is a sample of just some of J P Morgan Chases’ extensive shareholdings. My research led me to question whether the same pattern of common directorships could be repeated in these other companies, so I next analysed Merck. Here are the results:

Merck & Co Incorporated, another pharmaceutical company, also has 2 directors who sit on the board of JP Morgan Chase, one of whom is not only Chairman of J P Morgan Chase, but also a director of the New York Stock Exchange.

Could this be just coincidence? Highly unlikley. It is my opinion that this demonstrates a definite structured approach to the control and ownership of some of the largest companies in the world.

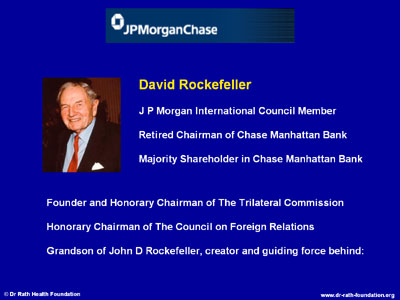

The Inner Circle group is now a little bigger. I have still not revealed the identity of the mystery man because, first, it is necessary to examine the company J P Morgan Chase again.

This time, I looked at the Advisory Board of the company. Investment companies like J P Morgan Chase have advisory boards that control the investment policy of the company – in other words, they decide what type of companies to invest in and whose shares to buy.

The J P Morgan International Council is the most senior of their advisory boards and upon examination of the members of this Council, the key figure, the mystery man is finally revealed:

David Rockefeller, grandson of John D Rockefeller, creator and guiding force of the ‘Business With Disease.’

JD’s grandson David is doing a fine job upholding the family traditions. As owner and past chairman of the Chase Manhattan Bank (now part of JP Morgan Chase) his wealth, power and influence extend way beyond oil, pharmaceuticals and banking – still the powerhouse of Rockefeller wealth – as is demonstrated by his other connections.

1x As founding father of The Trilateral Commission, David Rockefeller has enjoyed unparalleled private access to the world’s political and business leaders for nearly 30 years, providing the Rockefeller dynasty with the opportunity to pursue its criminal ‘business with disease’ unopposed. There is more information about the Rockefeller financed Trilateral Commission on the Dr Rath Health Foundation website.

The family has managed to build and successfully maintain the ‘business with disease’ for more than 60 years, through personal influence, control of banks, ownership of pharmaceutical and petrochemical companies, financial support for their favored politicians and a multitude of other practices originally developed by the patriach John D Rockefeller,.

As my evidence shows, David Rockefeller continues the traditions.

These facts provide clear evidence of the criminal activities of the ‘business with disease’ that are the subject of the charges being heard today.

That concludes my testimony for the prosecution.

In closing I would add that, by participating in ‘The Hague Tribunal’ you are helping to initiate the process by which the ‘business with disease’ will be finally dismantled and brought to justice. The criminal acts of this industry can then be replaced by a health care system that focuses on safe, effective, non-patentable and side effect free natural therapies.

The dismantling of the Rockefeller inspired pharmaceutical business model will lead to the collapse of the financial empire that is built upon those illegal practices and thus to the release of massive funds for re-investment into changes that will lead to future peace, good health and social justice for us all.

Thank you.